does tesla model y qualify for federal tax credit

Jun 27 2019. Tesla Model X Toyota 4Runner Landcruiser Sequoia Tundra Note.

Tesla Hikes Price Of Model 3 Model Y By 2 000

Then require only new zero emission autos sold after 2050.

. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. I just put the deposit for Tesla Model Y but holding to get delivery until 7000 federal credit. Please consult with your accountant regarding the eligibility of any particular vehicle.

This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. Per the federal governments definition the price used to qualify vehicles for. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Like to know as soon as federal credit is. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. I believe Anyway the new Tesla Model Y came out for the consumer and it is below 6000lbs which is the threshold for qualifying.

This definition is generally also adopted by provinces for provincial programs. If you act quickly the Ford Mustang Mach-E and Volkswagen ID4 are still eligible for the full credit. GM would be the big winner with the updated regulations while Tesla would again receive some federal tax credits.

Can Both New and Used Vehicles Qualify for Section 179. Tax Liability is not based on tax withholdings. According to Electrek the Tesla Model Y Long Range is 9000 more than it was at the start of 2021.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. One of the incentives for buying an electric vehicle is the federal tax credit. This is a Tax Credit that is used to offset a Tax Liability of up to 7500.

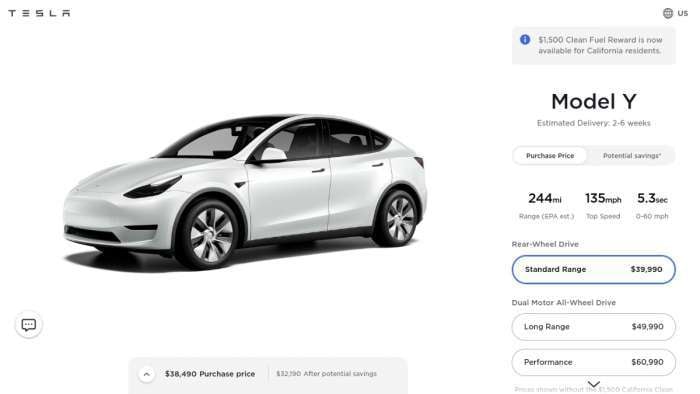

Aspiring Tesla owners should pay close attention. Entry level model S starts at 79690 Model 3 starts at 39690 Model Y starts at 51990. Has sold more than 200000 vehicles eligible for the plug-in electric drive motor vehicle credit during the third quarter of 2018This triggers a phase out of the tax credit available for purchasers of new Tesla plug-in electric vehicles beginning Jan.

3750 for tax years 2025-26. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. That should be fair sales for US buyers and from all auto manufactures sold in the US.

Qualifying for a deduction will depend on stated use vehicle GVW which varies with trim packages and options and more. IR-2018-252 December 14 2018. First here are some Tesla vehicles that will qualify for the Tax Credit.

Local and Utility Incentives. Why is Teslas lineup no longer eligible and which manufacturers still receive tax credits. For Teslas bought on or after January 1 2020 there has been no federal tax credit.

I did a little more digging on certain tax forms about bonus depreciation under 179 if the vehicle weighs less then 6000 lbs. EV tax credits jump to 12500 in latest legislation -- with a catch. Several months later it seems that revisions to the credit are returning to lawmaker agendas.

The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit. In President Bidens State of the Union address the President voiced support for revisiting EV tax credits in 2022. Currently state of California is offering 2500 credit.

By 2020 the subsidy will be zero dollars for Tesla. In May 2021 the Senate finance committee considered the Clean Energy for America Act that suggested modifications to a number of existing programs associated with clean energy among them being the EV tax credit. Unfortunately Tesla vehicles are no longer eligible for this perk.

Currently Teslas are not eligible for any federal EV tax credits but they qualify for state tax incentives. The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

If you had wages in the year and Federal taxes taken out during the year then you can get the full 7500 as a refund even if you owe 0 on your tax filing without the car. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The federal government may be bringing back the EV Tax Credit for manufacturers like Tesla and GM who are no longer eligible.

This may allow you to claim a nonrefundable 7000 credit down by 500 for buying a new Tesla or GM electric vehicle part of the Growing Renewable Energy and Efficiency Now GREEN Act. The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles. WASHINGTON The IRS announced today that Tesla Inc.

Apparently you can deduct up to 18100 the first year. Electric Vehicles Solar and Energy Storage. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case.

Federal definition of MSRP The MSRP manufacturers suggested retail price shown on this page is based on the definition established by Transport Canada for the purposes of the iZEV federal EV incentive program.

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Model Y And Model 3 Dominates By Commanding About 2 3 Of Us Ev Market

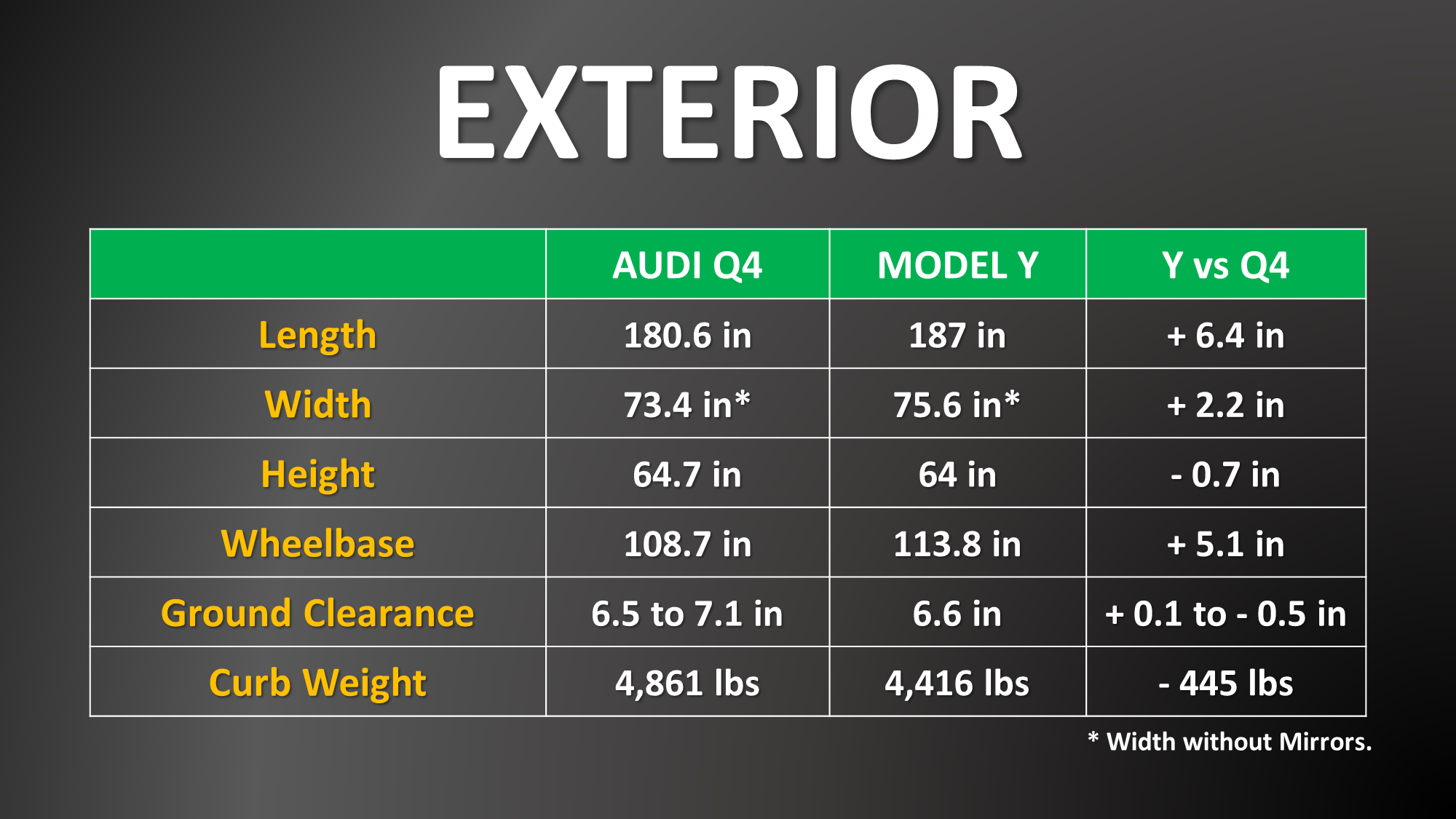

Audi Q4 E Tron Vs Tesla Model Y Which All Electric Suv Is Better Cleanerwatt

Check Out This Tesla Model Y Review After 35 000 Miles Newzsite

2022 Tesla Model Y Prices Reviews Vehicle Overview Carsdirect

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

2022 Tesla Model Y Prices Reviews Vehicle Overview Carsdirect

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Starts Deliveries Of Model Y Performance In China 24htech Asia

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Elon Musk Predicts Tesla Model Y Will Be World S Best Selling Vehicle In 2022 Fox Business

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

2021 Ford Mustang Mach E Vs Tesla Model Y The Next Normal

This Is Why We Think The Sr Model Y Will Soon Be 5 000 Cheaper In Canada Update Drive Tesla

2022 Tesla Model Y Prices Reviews Vehicle Overview Carsdirect

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator